missouri gas tax increase 2021

This is part of the states plan to increase. Missouris fuel tax of 17 cents per gallon has not been increased since 1996 despite having the 7th largest highway system in the nation.

2022 State Tax Reform State Tax Relief Tax Foundation

The Missouri Senate also passed legislation on Thursday that would raise the states gas tax.

. The tax increase could. If signed by Republican Gov. Under the bill the gas tax would increase 25 cents a year until reaching 295 cents per gallon in 2025.

Alaska is the only state with a lower gas tax with an eight-cent-per-gallon rate. On Tuesday July 13 Governor Mike Parson R signed Senate. On July 1 2022 the gas tax will rise again to 022 per gallon.

Missouri electric and hybrid vehicle tags cost between 3750 and 150. Missouri lawmakers May 11 approved raising the state gas tax 125 cents per gallon over five yearsThe bill could increase funding for roads and bridges by. This is a monumental achievement.

When fully implemented on July 1 2025 the gas tax would be 299 cents a gallon and would add 3375 million annually to the state road fund and 125 million for city and. Alaska is the only state with a. At the end of 2025 the states tax rate will sit at 295 cents per gallon.

The tax is passed on. 1 2021 Missouri increased its gas tax to 0195 per gallon. The GOP-led House voted Tuesday 104-52 to raise Missouris 17-cent gas tax by 25 cents a year until it hits 295 cents per gallon in 2025.

Senate Bill 262 you may be eligible to receive a. Use this form to file a refund claim for the Missouri motor fuel tax increase paid beginning October 1 2021 through June 30 2022 for motor fuel used. The Missouri General Assembly passed a gas tax increase in May 2021 to help fund road and bridge projects.

The bill raises Missouris 17-cent-a-gallon gas tax among the lowest in the nation by 25 cents a year starting Oct. For Motor Fuel Tax Paid October. It could raise as much as 450 million a vast majority of which would be.

Requests can be made for refunds from the motor fuel tax for the. The tax would go up 25 cents a year starting in October 2021 until the. Missouri drivers are getting their first chance to ask for money back from the states gas tax increase.

1 until the tax hits 295 cents per gallon in July 2025. Missouri receives fuel tax on gallons of motor fuel gasoline diesel fuel kerosene and blended fuel from licensed suppliers on a monthly basis. Missouris gas tax would increase for the first time in decades under a bill passed late Tuesday by the GOP-led Legislature.

To request a refund of the of the motor fuel tax. When fully phased in the fuel tax increase will cost the average Missouri driver about 70 per year. In 2002 2014 and 2018 Missouri voters opposed ballot measures that would have increased.

The Missouri Department of Revenue administers Missouris business tax laws and collects sales and use tax employer. May 12 2021. The tax is set to increase by the same amount yearly between 2021 and 2025.

1 2021 Missouris current motor fuel tax rate of 17 cents per gallon will increase to 195 cents per gallon.

Nebraska Gas Tax To Decline 4 5 Cents A Gallon In 2021

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Sustainability Free Full Text Students Preference Analysis On Online Learning Attributes In Industrial Engineering Education During The Covid 19 Pandemic A Conjoint Analysis Approach For Sustainable Industrial Engineers Html

Gas Tax By State 2022 Current State Diesel Motor Fuel Tax Rates

Illinois Doubled Gas Tax Grows A Little More July 1

Gas Tax By State 2022 Current State Diesel Motor Fuel Tax Rates

Biden Calls For Three Month Suspension Of Federal Gas Tax But Faces Long Odds Of Getting Congress On Board Cnn Politics

It S Been 25 Years Since The Federal Gas Tax Went Up Npr

Nebraska Gas Tax To Decline 4 5 Cents A Gallon In 2021

Gas Tax By State 2022 Current State Diesel Motor Fuel Tax Rates

Illinois Doubled Gas Tax Grows A Little More July 1

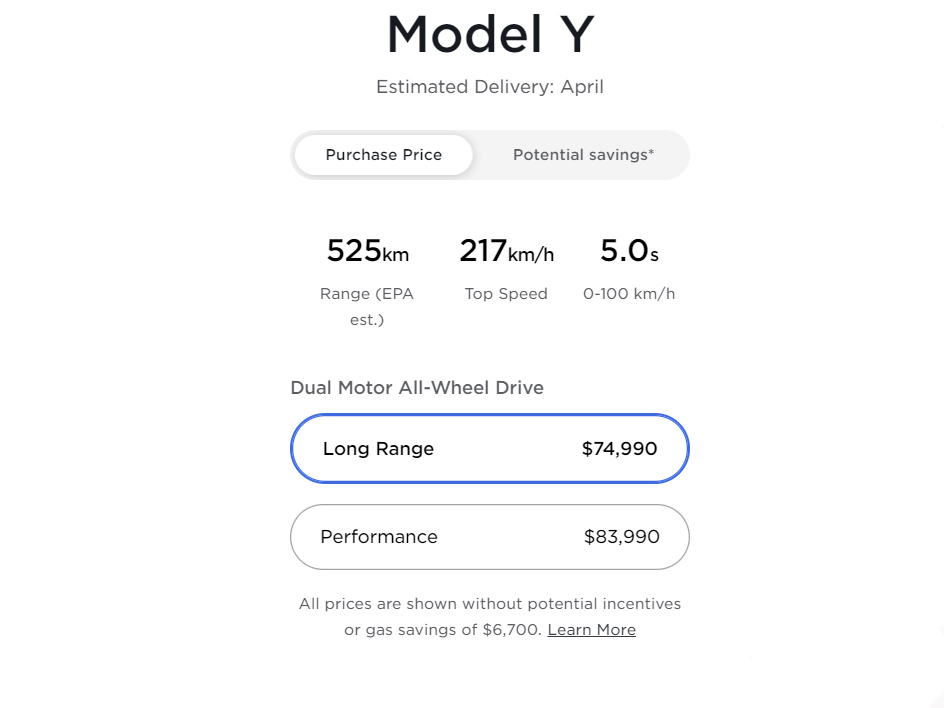

Tesla Increases Price Of Model Y In Canada Delays Expected Delivery Date

Gas Tax By State 2022 Current State Diesel Motor Fuel Tax Rates